Sara Tabbert

New Growth

Dyed veneer on carved panel, acrylic

10" x 10", 2022

Recently I came across an interview with the artist Sara Tabbert in which she said,

In some ways I am glad that I have never known what it’s like to have a full time “straight” job, salary, benefits. In addition, I have spent the past 23 years living with someone who is also self-employed. Sometimes it has felt like we are engaged in a high-stakes game of chicken, but neither of us want to ask of the other what we’re not interested in doing ourselves. And we are lucky to live in a place where we can dial our lifestyle down when we need to in ways that doesn’t happen much elsewhere. Still, as we both get into our 50’s, and watch friends start heading into a phase where their lives involve a lot more security, travel, relaxation, retirement possibly on the horizon – it’s hard not to wonder about the path not taken. We’ve been responsible, but it will never be easy and absolutely not luxurious. At the same time, yesterday I took two hours in the middle of the afternoon to go for a bike ride on our winter trails. All we ever really have is the moment at hand. You can’t be endlessly indulgent in pursuit of this idea, but you also can do everything “right” and still end up in trouble.

I love reading stuff like this: real life, lived by working artists making a go of it, so I'm featuring people in a Money for Artists questionnaire (a la Sari Botton’s Oldster and the Proust Questionnaire), and I’m starting with Sara.

Sara Tabbert

Argument/Arsenal

Carved and painted yellow cedar

24" x 48"

How do money and commerce intersect with your art or craft?

I made the questionable choice many years ago to base my income on my work, so it intersects very directly.

How do you pay the bills?

I work with commercial and nonprofit galleries, I pursue (or have in the past, it’s been a bit on hold of late) public art commissions, I work with clients directly for smaller commissioned projects. I sell work from my website, and starting last fall, I experimented with a very small, rented retail space. It’s open on a limited basis at my discretion. It went well enough that I’m renewing my lease for another year. For the last two years, I’ve been the shop manager/ main workshop instructor of a small community print studio that is part of a larger nonprofit. (This is not a major source of income, but also not nothing.) On paper I’m pretty low-income. But I’ve never been a “stuff” or status person so I don’t need a lot.

Everything has been a bit different the past few years. Between the pandemic and my studio fire it’s hard to say exactly where I’m at right now with money. The last two and a half years have been complete financial uproar, and I’ve had a lot of additional expenses with the rebuild and other consequences of that disaster. I have had to lean on my partner Brandon to help with the day-to-day during this time while I pay off debts and loans from all that. Up to 2021 I was pretty much an equal financial partner. Hopefully I’ll be back to that soon; it’s been hard to ask for that help.

What's a good month for you in terms of works sold? How does the need to pay rent on your retail space affect the need to “move product” (ugh)?

The retail space thing is still on the new side, but rent is manageable (currently $350/month plus it adds about a $100/month to my insurance.) Some months of the year were great, some total duds, some, like January, I chose not to open up. Even with paying rent, it’s more than I can make selling work through galleries. I worked very closely with a local gallery for 18 years, and to my great sadness the business closed in the pandemic and the owner, a dear friend, died of cancer a year later. It was an unusually collaborative relationship, not without the occasional friction of the gallery’s needs competing with the artist’s needs, but we did well and took care of each other. I doubt I’ll experience this again. I figured that now, while I don’t owe allegiance to anyone, this is the time to try this out. My landlord is my late gallerist’s brother, which is nice.

I have a subletter this summer who has the space through August, which helps, since I’m away. I also use the time when I’m in there there to focus on computer work, so even if nobody comes in I’m still getting work done. I was “open” an average of 9 days a month, mostly Fridays and Saturdays. Having a home studio is great but our location out of town and general funkiness of the whole outfit makes studio visits/sales a bit weird. Much easier to have a disconnected outpost.

Commerce is tricky. As far as “product,” I have made a few small, beautiful, easy to sell objects in addition to my larger more expensive pieces. It’s a small, helpful, compromise. Everything is always one of a kind (even these things) – selling reproductions is personally the hill I choose to die on.

Between what I sell myself, what comes in from other galleries I work with, and teaching income, for me a $3,000 - $4,000 month is a really good month. That’s income, not profit. There are plenty of months that don’t hit that mark, sometimes there are bigger projects that float the leaner ones. Once in a while there’s a grant or an award, but those are few and far between.

What is your process for saving money? What bank/credit union/brokerage do you use? Do you have an autopayment system set up to set savings aside?

I use a local bank for personal and business checking. I have a Roth IRA through Vanguard and a traditional IRA, money market account, and “emergency fund” through Betterment. Again, don’t get excited, none of them are huge. The only one with a monthly autopay is the Roth, and I contribute to the others as I can.

My partner Brandon and I also have what we call the “oh shit” fund which is cash in a safe deposit box. We try to keep it at $10,000, but we had to take out a bunch last summer to pay for a dog de-legging (cancer). I felt very drug dealer when I was driving around with (prescribed, for the surgery) ketamine, oxycodone, and six grand in cash to pay the vet. We’re back up to $6,500 now. The idea is that it just sits there forgotten, but can pay for something like this, or the down payment on an emergency vehicle purchase, etc.

I have high deductible health insurance through the federal Marketplace; I also have a HSA with about $10,000 in it.

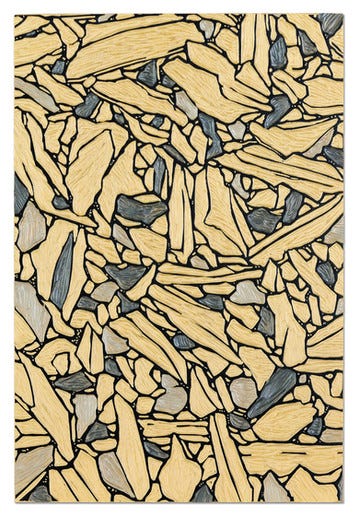

Sara Tabbert

Scree

Relief carved and painted yellow cedar panel

17” x 7.5”, 2017

What’s your favorite thing to spend money on?

I love, love, love good food and good restaurants. Luckily, we have few of the latter in Fairbanks (aside from one good Thai restaurant for every five people) so most of this happens in travel, which I don’t do a ton of.

What do you hate spending money on?

Gas. I skate close to empty way more than I should.

What is a small purchase (say, under $20) that gives you great satisfaction and which you would recommend to us?

I sure do love a good cookie when out doing errands around town.

Do you have a financial advisor of any kind? Why or why not? If yes, how has it worked out?

I don’t have a financial advisor, but I do work with an accountant who has been very helpful and has played something of this role. She was amazing during the pandemic in helping with the various assistance/grants to small businesses. She also helped us walk through the process of getting a tax credit for putting a bunch of our property into a conservation easement, a learning process for all of us.

Working artists are so often faced with intense precarity at many points in their lives. Beyond Social Security, what, if any, hedges against precarity have you developed? What's the formula? What are you dreading/planning for/hoping for in old age?

Aside from both having modest retirement savings, one big hedge is owning property and buildings basically outright. We live in an area with no building codes, so if you live in it and want to call it a house, it’s a house. This has allowed for things to be built slowly, mainly out of pocket, remain unfinished for long stretches of time, and have unconventional systems. We may have three substantial buildings on our property, [but] we’ll probably never have an indoor toilet. There are modest family loans on my new studio and our house that is under construction, but both of those will be paid off within the next four years. Neither of us currently carries any other debt. Another hedge is being part of a community that has a tradition of helping each other.

I dread the decision in old age of whether to stay or go from Alaska. Alaska is tough when you’re old and Fairbanks is particularly tough. Do you cross your fingers and hope the lifestyle you built in one era of your life is sustainable later on? (I’m not sure ours is….) Do you leave soon enough to make connections and community elsewhere? Lots to consider.

Do you have a side hustle? What and why and is it worth it?

Right now the contract workshop teaching/ shop organizing is the only non-art-making work I do. It varies from month to month, probably a max of 25 hours a month down to zero hours. Up to the age of 40 I had regular side hustles of various kinds. (I’m 54 now.) I spent a lot of time working in kitchens and bakeries. I worked on farms. I did home-health-care-type work for seniors. They were all jobs that either were seasonal or that I could drop when art provided enough income. There came a point where my partner and I decided that I probably could make more money just being in the studio (this says a lot more about what I got paid for my side hustles than what I make as an artist, don’t get excited). I liked most of my side work. I got to go to some interesting places, and I met great people through all of these jobs, but it’s much easier to focus now. And I totally forgot about this, because it is only in the last year that it has been making a little money rather than just helping pay off the property loan – we have a rental cabin that we rent to two artists as a studio. For cheap, of course. But, it’s exciting after so many years to see that account grow.

Sara Tabbert

In the Channel 2

Linocut prints and acrylic media collaged on panel

4" x 4", 2008

What is something you are saving for or want to save for?

I really have no business collecting art, but for a long time I’ve wanted to have a collection of handmade mugs from different artists. We are also in the process of building a house so we can move out of the unfinished shop/“house” building we’ve been living in for 20 years, so that is the focus of most non-frivolous saving.

What is a (happy, sad, painful, funny) childhood memory you have of money or class?

I grew up in Fairbanks, Alaska and class is a little harder (or was in the 70’s/80’s anyway) to distinguish than in other parts of the country. People tend to hide wealth rather than flaunt it. I went to college young, and naïve, and I think somewhat as a fluke at a fancy liberal arts college. I couldn’t for the life of me figure out how my new friends had all these experiences – extensive world travel, volunteer opportunities, etc. Everyone was busy kind of playing hippie and living dirtbag, which I certainly could do. It wasn’t until years and years and years later when had spent more time in the lower 48 that I realized that so many of them were from fancy suburbs of big cities with corresponding family budgets – like, oh, Shaker Heights is not Cleveland, Palo Alto is not San Francisco, Evanston is not Chicago. Then some of it made sense. I am still learning about class.

In a single word or phrase, how would you describe your relationship with money?

Anxious.

How much did your family of origin shape that relationship?

A lot, probably. Not to get too deep into it, but my dad grew up stressed economically (small family farm in northern Iowa) and probably some other things from earlier generations that don’t make it easy. Don’t get me wrong, there are some very useful lessons from my family – be resourceful, buy good things and fix/maintain them, plan ahead, don’t do instant gratification, etc. I didn’t choose an easy life for someone who is inclined to worry about money. My parents are very fortunate in that they are financially secure in their older years and retired with what today seems like unimaginable (to me!) access to health care. But they still worry. I had a facepalm moment when visiting recently when my mom told me about how she’s buying imitation vanilla because the real stuff is “too expensive.” It’s SO not too expensive, for her, at least. But those lessons are deep, deep, deep.

If you could wave a magic wand and change one small thing about how our current economic system works, what would you change?

Equal and reasonable access to good health care, dental, hearing, vision. All the things that this would make possible for so many people.

What are you working on now?

Right now I am in the middle of a two-month residency in Philadelphia, hosted by the Museum for Art in Wood, and my fellow residents (fellow fellows?) are starting to feel the heat of our upcoming exhibition! I’m working on some mixed media pieces that combine marquetry (work with wood veneer) with printmaking and other techniques.

Where can we see some of your work?

I have a good but imperfectly up-to-date website, www.saratabbert.com. If you are out East, the residency exhibition opens August 2, and will be on exhibit through most of October. Otherwise you’ll mainly find me showing around the state of Alaska, with some outposts in Oregon and Maine.

What is a secret (a memory, a quirk you have, a hope—about money or anything else) you feel comfortable sharing?

My hope is to get to a point where I feel like I am secure enough to give away a substantial amount of money. I’d love to be able to really, meaningfully directly help someone – pay their rent for a year, erase someone’s mortgage, buy them a car. No strings, no systems, nobody needs to know about it except the two of us.

Sara Tabbert

Tinder

Relief carved and painted yellow cedar panel

24" x 18", 2017

See more of her work at www.saratabbert.com and @saratabbert on instagram.

I love Sara's work and her confidence with an unconventional life. And I love how your questions help to illuminate the real balancing act of choosing to be an artist. Bravo to you both!

Great interview! I've been having financial anxiety lately but yesterday I stopped myself and realized if I had complete control over my days I would want them to look very much like they do. That is worth a lot. And that was what I thought of as I build my life, not retirement. But now as I age, retirement does matter in how I build by days going forward--well sometimes the fact that I didn't think much about it gets to me. This article brings me back to the possible, and the why. Thank you.